Maximizing Returns with Value-Add Multifamily Properties

You may have come across the term “value-add” when looking for potential multi-family investments. Property sellers seem to use it every chance they get.

When pitching an outdated, or neglected property, they will probably say it’s a great “value-add investment opportunity” as a way to talk about its hidden potential.

This has resulted in the term being overused, so investors must fully understand what it means before delving into value-add investments.

Here we will explain exactly what a value-add opportunity is, its advantages, and the steps necessary to analyze and implement such investments.

Value-Add Investment Opportunities Explained

Value-add opportunities are deals that offer buyers potential increased returns by taking advantage of disparities in the market.

By adding value to a well-located, but poorly maintained or undervalued property, you can increase rents to the average rates in the area, or even above average.

Simply put, the ideal value-add investment is that “weed among flowers” meaning it’s a property in a desirable community, but it has been neglected or mismanaged.

Value-add investors should be able to see the potential in upscaling the asset and take advantage of its positioning.

As Ralph Waldo Emerson said, “What is a weed? A plant whose virtues have not yet been discovered” So, value-add investors who can “discover the virtues” of the underperforming property can reap handsome financial benefits from their investment.

This is the perfect analogy for a real estate asset that is not being utilized to its full potential.

Not all properties however have the capacity to be molded into high-income producing assets.

They need to meet two basic criteria, namely, the problems with the property must be solvable, and the investment needs to be financially viable.

Let’s explain.

You may have found an old residential building that has not kept up with the surrounding buildings meaning rents are significantly lower than the market rate.

As an investor, you would look at the cost of upgrading the property to a standard that can compete with others around it.

These upgrades could be fairly simple tweaks like a fresh coat of paint or new flooring and fittings.

If there is severe structural damage or a considerable amount of maintenance to be performed, the cost to fix these issues will exceed your income even with increased rents.

Older properties especially may require a “gut rehab”, which does have its benefits, but may be too costly to justify the expected increase in rental income.

To be financially viable, the increased rental revenue from the upgraded property should pay for all renovation and maintenance expenses within four years.

In addition to ensuring financial viability, be wary of properties that have already undergone extensive renovations and the rents subsequently increased.

The seller might try to convince you that some minor improvements could result in even higher rents but this may not yield enough income to cover your expenses.

Another important criterion that needs to be fulfilled is being certain that the problem is solvable. This will require a thorough investigation of the surrounding properties with which you would be in direct competition.

If the neighborhood has a high demand for large multi-family dwellings, while the property you are offered consists of small, studio apartments, it’s almost impossible to bring it up to par or gain a competitive advantage.

To sum it up:

Find a well-situated property.

Buy the property at a price below market value.

Make physical, structural, and operational upgrades.

Reposition the property to a level consistent with properties in the area.

These steps will help attract new tenants and reduce the vacancy rate. This in turn will generate higher rents.

Once you have a lucrative property in mind, you must determine the benefits you stand to gain after value-add renovations.

What are the Perks of Value-Add in Multi-Family Property Investments?

The most obvious benefit from successful multi-family value add investments is the income you will earn by raising rents.

The multi-family sector has continuously outperformed other types of commercial real estate (CRE) assets despite economic and industry-specific downturns.

Demand for modern, quality apartments has steadily increased as more Millennials prefer to rent for longer instead of buying a home. This demand is further compounded as Baby Boomers with “empty nests” are downsizing their homes.

Right now, we’re in what’s being called “the golden age of multifamily investing”, it is estimated that America needs 4.6 million additional apartments by 2030 to meet demand.

In addition to the profit earned from higher rents, several other reasons make multi-family value-add acquisitions financially rewarding. We discuss a few of these below.

- Strong demand for upgraded apartments: With almost 50% of apartments in the US having been built before 1980, the demand for value-add properties far exceeds supply and a well-executed value-add investment strategy can generate long-term profits.

- Multi-family is one of the largest asset classes in real estate, with a large portion of the annual consumer expenditure in the US going towards housing

- Potential for rent growth: Regular value-add improvements, such as interior renovations offer predictable growth in rental income.

Low-vacancy rates: Even during slumps in the real estate market, multi-family investments have proved to be resilient.

Analyzing Value-Add Multifamily Investment Opportunities

So now that you have identified several lucrative properties, you need to know how to analyze value-add multi-family investment opportunities.

Here is a brief overview of some of the key elements to guide you on how to evaluate a multi-family investment property.

Compute Your Net Operating Income (NOI)

The NOI is an assessment of the property’s ability to generate income and is calculated by subtracting the expenses a property incurs annually from the gross annual income. This will help you determine the capitalization rate which is an important indication of an investment’s profitability.

Calculate the Capitalization Rates

The capitalization rate (cap rate) of a property is one of the most important factors to consider when analyzing a value-add investment deal.

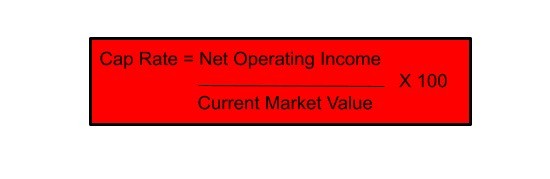

The cap rate is determined by dividing the property’s NOI by the current market value or listing price and expressed as a percentage.

It is an industry-standard metric used by investors and brokers to gauge a property’s profitability.

Higher cap rates usually correlate with dilapidated properties in rougher neighborhoods. Properties with low cap rates are likely to be found in more affluent areas closer to business hubs and city centers.

Look at the demographics of your target market, property location, and economic conditions in conjunction with the cap rate as they also influence your returns.

Perform Due Diligence

Many real estate investors can probably tell you that cheap can sometimes be expensive, and if it’s too good to be true, it usually is.

Be wary of exceptionally cheap properties that are advertised as guaranteed value-add opportunities.

Investigate the property’s history keeping an eye out for unpaid penalties, violations, environmental risks, and pending lawsuits. These setbacks could end up consuming all your time and money, essentially negating all your potential profits.

Inspect the building with an expert appraiser to check for structural damage or anomalies. Your level of care when performing due diligence could be the difference between investing in a goldmine or buying a dud.

Know Your Neighbors

A simple way to determine if the property has the potential to earn substantial NOI is to look at similar rental buildings in the area.

If the NOI of your proposed property is lower than that of surrounding assets, or rents are below average, this is a good indication of its profit-making capabilities.

Choose Your Value-Add Strategies

Determine which type of enhancements will maximize results with minimal financial input. The enhancements you choose to add value will depend on the type of property and market conditions.

There are three broad categories of value-add opportunities: capital upgrades, operational enhancements, and total repositioning.

Capital upgrades or improvements are those that enhance the desirability of the property. They would typically be interior and exterior upgrades that will compel residents to pay higher rents — but more on that below.

Operational enhancements aim to improve the management of the property. These changes require little, to no capital investments and can include raising rents to market levels, reducing maintenance costs, and enforcing ancillary fees.

Total repositioning is achieved by combining capital improvements and operational enhancements to elevate the marketability of properties. This gives you a chance to target tenants with deeper pockets.

Multi-family value-add investing requires an investor with a long-term time horizon strategy along with a fair amount of risk tolerance.

If the property matches your investor profile, and you deem it worth the risk, the next order of business is to improve the property to increase its value and cash flow.

Implementing a Successful Value-Add Strategy

As discussed above, the end game behind initiating a value-add project is the additional income earned as a result of making a property more valuable and increasing the NOI.

The two ways to increase the NOI of a commercial multifamily investment are by either increasing income or reducing expenses.

Typical renovations such as remodelling kitchens and bathrooms, repainting interior walls or installing new flooring and carpeting work towards increasing rents and NOI. Older homes may also need new plumbing and electrical fixtures.

When conducting such upgrades, it is advisable to avoid overly expensive speciality finishings but choose timeless, quality designs that appeal to the general population.

A value-add strategy that aims to reduce expenses is another way to raise the NOI. An example would be reducing the amount of energy and resources the building consumes.

When refurbishing the plumbing of an old building, consider installing energy-efficient boilers along with zone valves for each one.

The valves will control the flow of heated water through different zones in the building depending on the temperature.

Along with reducing maintenance costs, it is a strategic method of controlling expenses instead of just increasing income.

Hiking rents is the surest way to raise NOI, but what if you have already reached the optimal rental price?

Although rents are constantly rising, you still need to offer housing at affordable rates, or potential buyers will find a similar, yet cheaper apartment.

This means you will have to think of ways to increase non-rental income.

Here are some creative, and fairly inexpensive ways to improve your NOI by giving residents the option to pay for services.

Offer Paid Laundry Services

Some property owners may not be able to afford to outfit each home with laundry machines but acknowledge the boost such equipment will have on rental income.

By installing on-site laundry machines, you can slowly raise money for individual machines for each tenant as units are vacated.

The cost is fairly minimal, and the machines usually have a long-term guarantee.

Tenants will also appreciate the convenience and affordability of an on-site laundry service instead of hauling their clothes to and from laundromats.

Create Storage Space

If there is unused space in or around your property, converting it into storage space will give you a steady stream of non-rental income along with providing tenants with a valuable service.

Although the cost of converting extra space into storage units might have a high upfront cost, the income earned will go directly to improving NOI.

Do adequate research about your target market to confirm that potential tenants will require storage space.

The storage space can also work to attract your desired type of tenants. If for example, you position your property as an ideal home for ‘baby boomers’ looking to downsize, it is likely they will have a lifetime’s worth of possessions and will need convenient and accessible storage facilities.

Phase in Ancillary Fees

It is common for multi-family building owners to charge ancillary rent, including fees for parking and pets.

You should consider including parking fees in your lease agreements especially if you live in a densely populated area.

Depending on how much parking fees are in the neighborhood, you can charge a monthly rent for parking space at a lower price.

It is also a good idea to charge fees that are payable only when a specific event occurs such as late payment fees and move-in fees.

This will create an ancillary income stream independent of rental income. Be sure to consult with existing tenants before implementing any new charges so as not to alienate them, and possibly push them out of your property.

Take Advantage of Value Add Investing’s Bright Future

The unstoppable passage of time that sees properties age and fall into disrepair means that investing in value-add properties will endure as a profitable strategy for investors.

Coupled with ever-changing market conditions and increasing demand for multi-family dwellings, value-add properties continue to increase in value and provide new revenue streams for buyers.

Within our current environment of escalating rent growth and low-interest rates, value-add multifamily investors are raking in handsome profits so there is no better time than now to capitalize on value-add properties.

Success depends on your creativity, strategic discipline, and most importantly, knowledge of the value-add market.

For expert advice from leaders in the real estate market, attend the Real Estate Masters Summit for inside knowledge about multi-family real estate.

The 4-Day Free Online Multifamily Summit will give you access to accomplished industry gurus with a wealth of information, tips, and first-hand advice.

Sign up for a limited time to get your FREE ticket to the Summit now and dramatically grow your business the easy way.